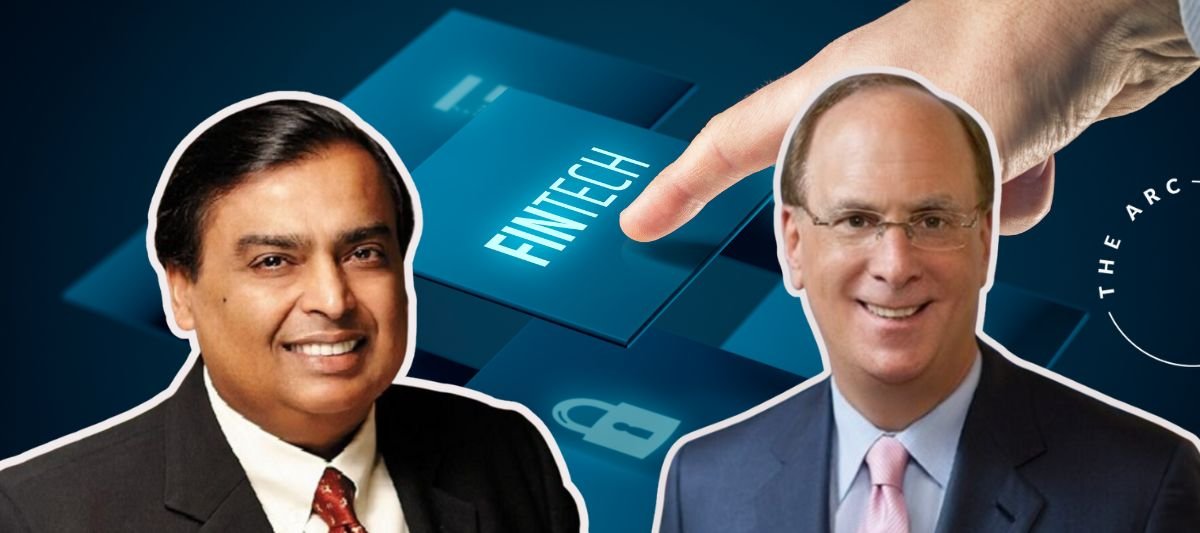

Jio Financial Services and BlackRock announce a $300 million joint venture to launch a new asset management company, reshaping India’s investment landscape.

Introduction: In a landmark move set to reshape India’s financial ecosystem, Jio Financial Services Limited (JFSL) has joined hands with global investment giant BlackRock to launch a $300 million asset management joint venture. This powerful collaboration aims to tap into the rising demand for investment products among India’s growing middle class. With Jio’s deep digital reach and BlackRock’s global expertise in asset management, the new entity is expected to offer low-cost, tech-enabled investment solutions to millions of Indian investors.

A Strategic Collaboration for India’s Investment Boom India’s mutual fund industry has witnessed unprecedented growth in recent years, with individual investors seeking smarter, tech-driven ways to manage their wealth. Recognizing this shift, Jio and BlackRock have entered into a 50:50 partnership, each committing $150 million to the venture. The goal: to revolutionize asset management in India through digital innovation, accessibility, and affordability.

Jio brings to the table its robust digital infrastructure, customer insights, and access to millions of users through its telecom and digital services ecosystem. BlackRock, on the other hand, is the world’s largest asset manager, with a reputation for risk management, portfolio diversification, and global investment strategies.

What This Means for Indian Investors The collaboration promises to make professional-grade investment tools accessible to the average Indian investor. Using AI-driven advisory, user-friendly interfaces, and low-entry barriers, the platform could attract new demographics previously excluded from traditional investment vehicles.

Financial inclusion is at the heart of this partnership. For small investors in tier-2 and tier-3 cities, this venture could be a gateway to organized wealth creation. The expected launch of mutual fund products, ETFs, and retirement planning tools will further deepen the investment culture across the country.

Industry Reactions and Expert Opinions Market analysts have welcomed the venture, seeing it as a game-changer in the Indian asset management industry. According to analysts, this partnership could put pressure on existing mutual fund houses to innovate and cut costs.

Industry experts also believe that the Jio-BlackRock partnership is more than just financial collaboration; it is a convergence of technology, trust, and financial empowerment. The strategic vision behind this move aligns with the Indian government’s push for digital financial inclusion.

Challenges and the Road Ahead Despite the optimism, the venture will face challenges. Regulatory hurdles, intense competition from established players, and investor trust are key issues that need to be addressed. However, with the right strategy, strong branding, and smart execution, the Jio-BlackRock alliance is poised to disrupt the market.

Conclusion The $300 million joint venture between Jio Financial Services and BlackRock is more than a business deal—it’s a bold bet on India’s digital future. As the platform takes shape, all eyes will be on how it redefines investment access for millions and sets new benchmarks in financial services innovation.

Stay tuned as we track this exciting partnership and its impact on India’s financial landscape.